Client Use Cases

Investment Advisor Data Leak

A registered investment advisor (RIA) has a business of bringing hard to acquire deals (private investments for qualified buyers). The RIA is compliant with SEC guidelines, but it fears a recurring data leak within its current clients. New deals that are confidential are being leaked into the media and public. If the RIA is suspected of not protecting the investment sellers, they will no longer receive these rare deals. LeastTrust is hired to implement several data tracking mechanisms that are both a deterrent yet also evidence and provide digital assurance that it client base is not the source of the recurring leaks. This clear “chain of title” data tracking system has end to end assurance to both the RIA and its investment providers.

Family Hit by Online Fraud

A high net worth family had recently suffered two cyber events. One was ACH fraud from a wedding catering vendor that was infiltrated by an offshore adversary. $45,000 of funds were sent to the an account that was invoiced from that adversary claiming they had addition bank account for large payments. The loss was not recoverable. Additionally an older family member had been scammed out of a cryptocurrency scheme.

The family wanted to uplift its cybersecurity posture. With the help of LeastTrust IT: several new controls were included in the family IT umbrella: Passkey adoption, delegation of all payments to one trained individual, use of VaultBooks for all non social or everyday activities, mandatory attendance at security training workshops (both recurring and emergency), and an open hotline to alert or verify a questionable event.

Training, Hardware, Policies, and Practice now keep this family and its investments safe.

Dentist Office Cyber Insurance

A local dental office lost its cyber insurance after it had a breach due to “lack of MFA”. The incident was minor in terms of systems affected and no PHI was leaked, but the wakeup call was real. How would they endure the “next” attack?

Our team advised and implemented a SSP (System Security Plan) that included 100 CIS controls which far exceeded the ever growing requirements in cyber insurance application so that the practice is ready for the coming years hurdle(s). The practice is well positioned to evidence and acquire favorable cyber insurance coverage, but also well positioned to evidence regulatory HIPAA, GLBA, or PCI requests should they arise in the future.

Learn More

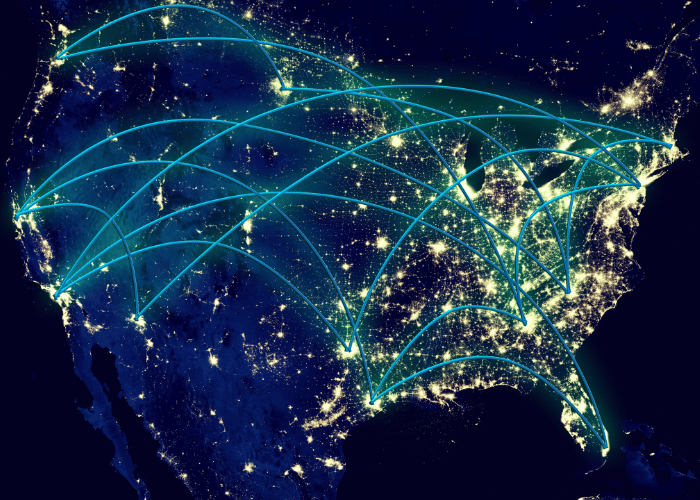

Nationwide Coverage

Our Team is located across the United States and can respond to your needs virtually in real time or be on location in hours.