Insurance Readiness

Carriers are not offering policies to organizations lacking strong security controls

We evidence your organization's security, making it easy to acquire insurance

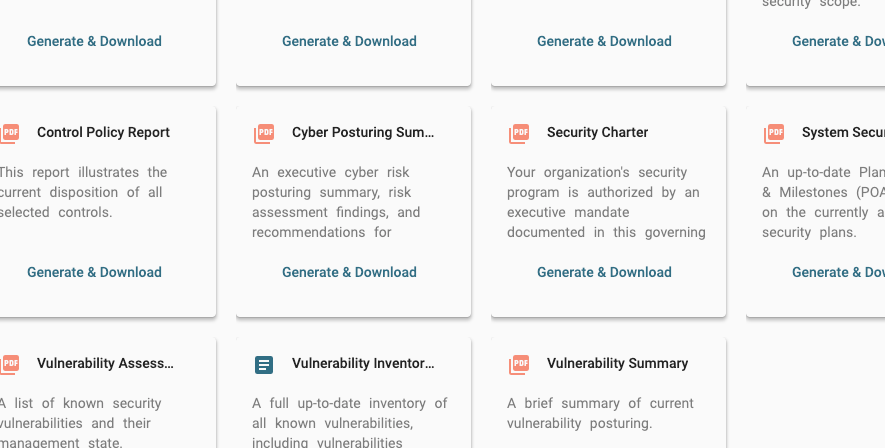

Real time documentation of continuous compliance to world wide standards such as CIS (Center for Internet Security) or NIST, allow either us or your team to print out deep detailed documentation of your organization’s world class security portfolio. The underwriters are seeking “good risks” policyholders like your organization.

Insurance FAQ

Why have insurance policy rates increase over 1000%?

Insurance loss rates due to ransomware, wire fraud, invoice spoofing, phishing, reputational damages, data loss, and business disruption have forced carriers to dramatically increase rates for cybersecurity coverages

Where do I attain advantageous coverages

Inquisitive IT has several relationships with Insurance carriers and brokers specifically serving small and medium sized business. We would be happy to introduce you and assist where needed

What requirements do all insurance applications require

Every couple months the insurers require additional controls. The most recent being vulnerability management and patching and electronic money handling (Wires, ACH, etc). Inquisitive’s standard controls continue to exceed the requirements for the past 3 years and we have yet to need to add additional controls to meet any application

Will insurance rates ever decline?

The good news is that year or year increases have fallen off. At some point in the future we hope that the insurers will differentiate organizations representing superior risks and warrant lower premiums. Its still in flux, but one can hope

Learn More

Nationwide Coverage

Our Team is located across the United States and can respond to your needs virtually in real time or be on location in hours.